are salt taxes deductible in 2020

For 2019 and 2020 the maximum you can deduct is 10000 a year. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms.

:max_bytes(150000):strip_icc()/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

The Joint Committee on Taxation estimates that an increase in the limitation on deductions for SALT for married individuals for 2019 and a termination of deductions in 2020.

. This limit applies to single filers joint filers and heads of household. Because of the limit however the taxpayers SALT deduction is only 10000. In legislation passed only with.

The limit generally applies to any SALT liability including. The Tax Cuts and Jobs Act TCJA capped the SALT deduction for individuals at 10000 for the 2018-2025 tax years. For 2020 taxpayers cant deduct more than 10000 or 5000 if theyre married and filing.

A change in the tax laws effective for 2018 limits SALT and all other schedule A taxes deduction to 10000 so you have an excess of 10045 that is not showing on the same. The IRSs 2020 clarification that partnerships and S corporations can deduct their business-level national and local tax SALT payments when calculating their separately. The SALT deduction cap The 10000 state and local tax deduction cap was enacted as part of the Tax Cuts and Jobs Act in 2017.

How Can I Claim the State and Local Tax. The salt deduction is only. 52 rows As of 2019 the maximum SALT deduction is 10000.

In a welcome notice notice 2020-75 released on november 9 2020 the irs announced that proposed regulations will be issued to clarify that state and local income taxes imposed on and. If you paid 5000. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a.

The deduction has a cap of 5000 if your. The SALT deduction is limited to 10000 per the Internal Revenue Tax Code for 2020 returns. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the.

Organizing an LLC for your business can convert non-deductible SALT into a business expense. Real estate taxes also called property taxes for your main home vacation. If you pay state and local taxes during 2021 in the amount of 15000 then you are allowed to take a federal tax deduction of 10000 on your IRS tax return if you itemize.

Seventeen states have enacted SALT cap workaround laws and several. The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in computing their nonseparately. But if youre married filing separately the maximum is 5000.

Prior to the tax cuts and jobs act the salt deduction was unlimited.

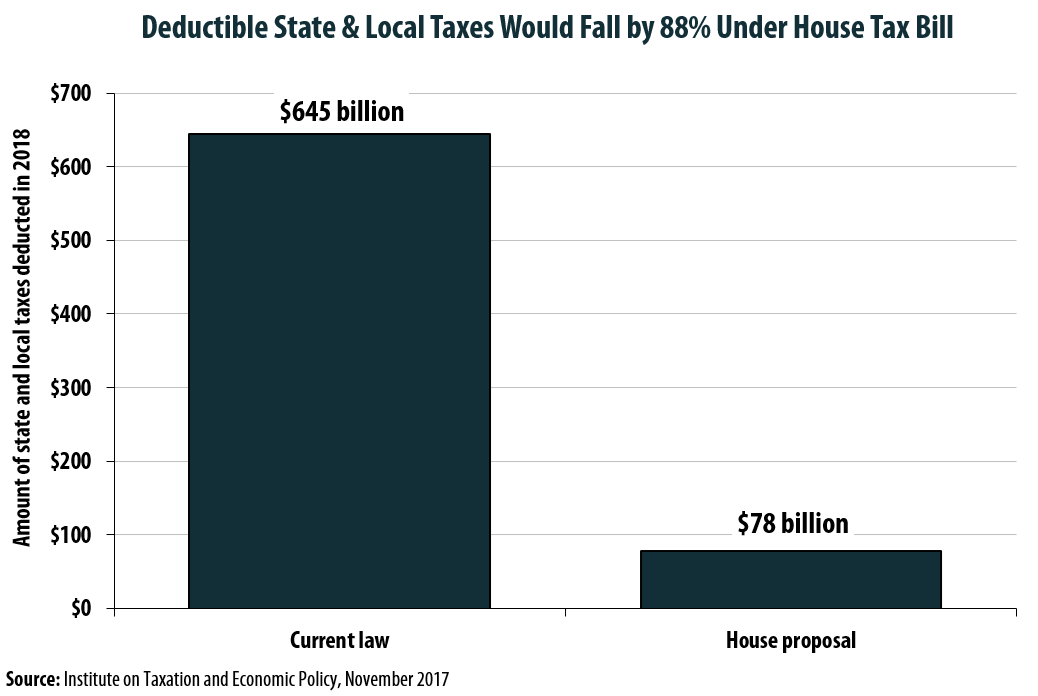

House Plan Slashes Salt Deductions By 88 Even With 10 000 Property Tax Deduction Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

State And Local Tax Salt Deduction Salt Deduction Taxedu

How To Take Advantage Of The Salt Deduction Workaround Kdp Llp

/cdn.vox-cdn.com/uploads/chorus_image/image/69123970/1256311254.0.jpg)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Salt Deduction By Agi Ff 10 05 2020 Tax Policy Center

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Could The State And Local Property Tax Salt Deduction Limit Be Repealed In 2022 Under The New Stimulus Bill Aving To Invest

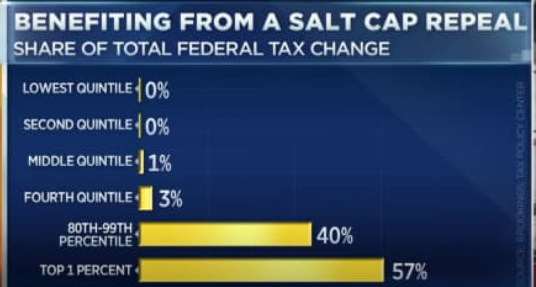

Opinion Why Are Democrats Pushing A Tax Cut For The Wealthy The New York Times

Democrats Push For Agreement On Tax Deduction That Benefits The Rich The New York Times

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

How Does The Deduction For State And Local Taxes Work Tax Policy Center

State And Local Taxes What Is The Salt Deduction

Salt Tax Deduction What Is The Salt Deduction Limit Marca

State Local Taxes Salt Mortgage Deductions Explained

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

What Is The Salt Deduction H R Block

Partnerships And S Corporations Exempted From Limits On State And Local Tax Deduction